Federal Employer Identification Number (fein) On 1099

They are all nine-digit numbers that are used for tax tracking purposes. Your companys EIN is like a Social Security number for your business and thus very important.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

A Federal Employer Identification Number FEIN is also known as a Federal Tax Identification Number Tax Payer Identification Number or Employer Identification Number.

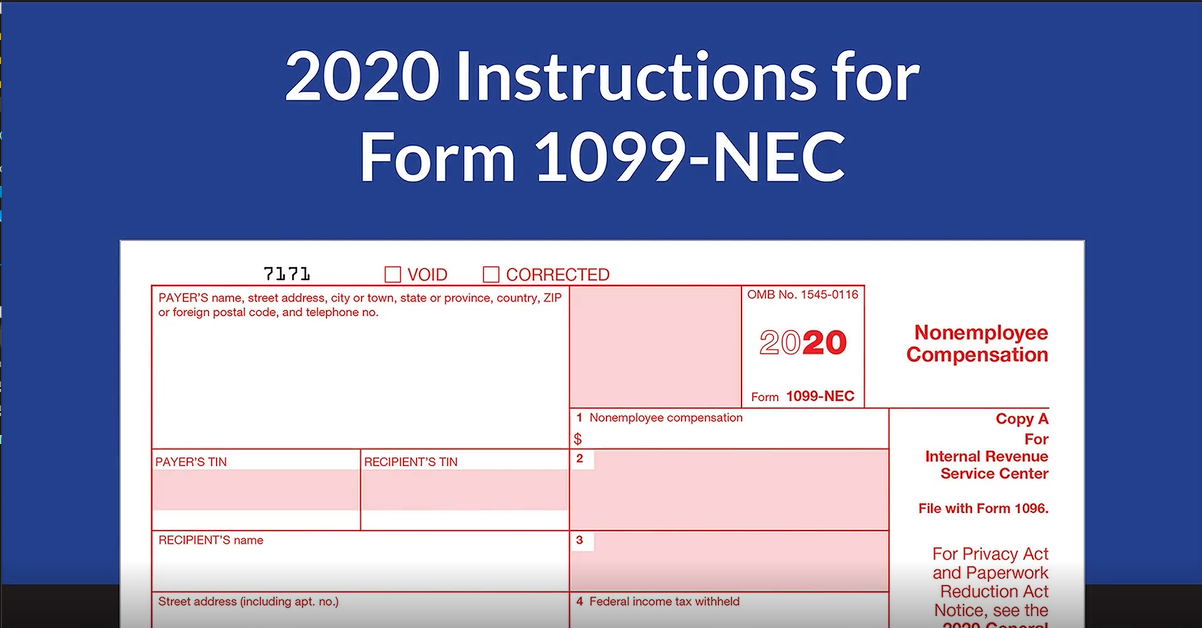

Federal employer identification number (fein) on 1099. On the 1099-MISC Copy B Instructions for Recipient state the following. Employers Quarterly Federal Tax Return. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

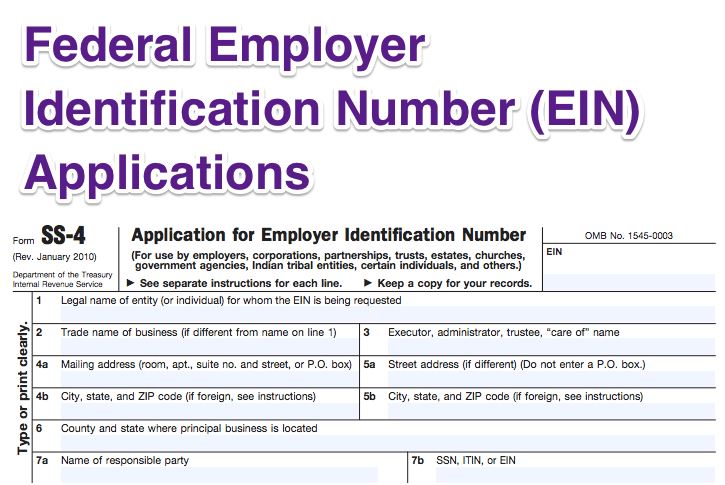

Local time Monday through Friday. An employer identification number also called an EIN or federal tax ID number is a unique numerical identifier that is assigned to businesses by the IRS principally for tax purposes. You cannot apply for an EIN online.

Eastern Time Monday through Friday to obtain their EIN. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Taxpayer Identification Number TIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format.

International applicants may call 267-941-1099 not a toll-free number 6 am. This limitation is applicable to all requests for EINs whether online or by fax or mail. As VolvoGirl said TurboTax has a separate place to enter SSA-1099.

Another option is to fax a completed Form SS-4 to your states service center for your state. You file excise tax returns eg alcohol tobacco or firearms. Form 1099 requires businesses to include their tax identification number referred to on the form as the employer identification number.

The number you posted is eight-digits in length. You file pension tax returns. Robert Collins A FEIN federal employer identification number is nine digits.

Effective May 21 2012 to ensure fair and equitable treatment for all taxpayers the Internal Revenue Service will limit Employer Identification Number EIN issuance to one per responsible party per day. An Employer Identification Number is commonly referred to as a Federal Employer Identification Number FEIN or a Federal Tax Identification Number. On the 1099-MISC form or 1099-NEC form that you used to report payments by your business Getting IRS Help to Look Up Your EIN You can ask the IRS to search for your EIN by calling the Business and Specialty Tax Line at 800-829-4933.

The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 PDF Application for. A sole proprietor is not an employee of his own business. A Federal Employer Identification Number FEIN Employer Identification Number EIN and Taxpayer Identification Number TIN are all tax ID numbers used by the IRS.

To 1100 p. XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and employment. The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number FTIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format.

Often when referring to employer identification numbers people simply drop the word federal and as a result you may hear the abbreviation EIN. Generally businesses need an EIN. You may apply for an EIN in various ways and now you may apply online.

There is a free service offered by the Internal Revenue Service and you can get your EIN immediately. Generally businesses need an EIN. An Employer Identification Number EIN also known as a Federal Employer Identification Number FEIN or Federal Tax Identification Number FTIN is like a Social Security number SSN for your business.

Please call us at 267 941-1099 this is not a toll free number between the hours of 600 am. XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and employment tax reporting. There is no fundamental difference between these terms other than why we use them on various tax.

The unique nine-digit EIN number allows the Internal Revenue Service IRS to identify businesses for tax reporting. Since 2015 the IRS has stated that the employer identification number EIN can be masked similar to what is allowed for the Social Security Number TIN. This department is open from 7 am.

Daily Limitation of an Employer Identification Number. Social Security Number Employer Identification Number or Individual Taxpayer Identification Number in order to use the online application. Employer Identification Number EIN.

You may apply for an EIN in various ways and now you may apply online. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. Business owners will usually need an EIN when they.

Its the same number but it has a lot of different terms depending on what its being used for. A federal employment identification number FEIN is the exact same thing as an employer identification number EIN. A sole proprietor must have a federal Employer Identification Number EIN if any of the following apply.

Form 1099-DIV - No EIN or Payers FEIN. If you receive a dividend income report without a payers identification number enter the information as though you had received a 1099-DIV but leave off the Payers Federal Identification Number. They should respond within roughly one.

Some businesses such as one-person sole proprietorships are not required to have an EIN. This number is not required and the return will electronically file without the number. Employer Identification Number for a Sole Proprietor.

You have one or more employees.

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms W2 Forms

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

What Is The Account Number On A 1099 Misc Form Workful

1099k Form Nuvei Payment Technology Partner

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Re Where Do I Find The Federal Id Number On 1099 Page 2

Tips For Filing Irs Form 1099 Misc Without An Ein Picnic S Blog

Ein Tax Id Confirmation Letter Confirmation Letter Employer Identification Number Drivers License California

What Is An Fein Federal Ein Fein Number Guide Business Help Center

Taxes 1099 R Public Employee Retirement System Of Idaho

Irs Ein Online Application Know The Benefits And Make Your Application Business Bank Account Filing Taxes Irs

Form 1099 Nec Instructions And Tax Reporting Guide

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

Posting Komentar untuk "Federal Employer Identification Number (fein) On 1099"