How To Write A Letter To The Irs For Identity Theft

To verify your identity. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

Irs Audit Letter 239c Sample 1

Once a tax filer receives the TRDBV by mail upload a copy to ASU as well as a signed and dated letter indicating that you were a victim of IRS tax-related identity theft and that the IRS has been made aware of the tax-related identity theft.

How to write a letter to the irs for identity theft. Letter to place an initial fraud alert. The business may require you to send them a copy of your Identity Theft Report or complete a special dispute form. A change in your refund amount.

Additional information is required. The tax identity theft risk assessment will be provided in January 2019. You get a letter from the IRS inquiring about a suspicious tax return that you did not file.

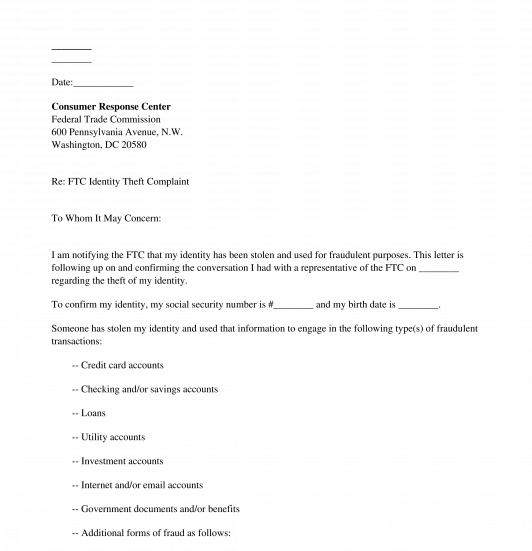

Write to each of the three credit bureaus. What you need to do. The IRS state tax agencies and private industry partner to detect prevent and deter tax-related identity theft and fraud.

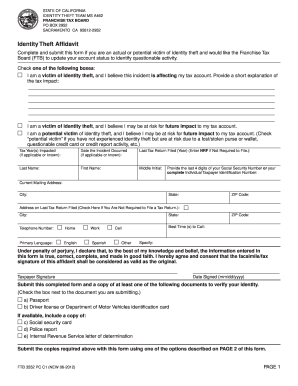

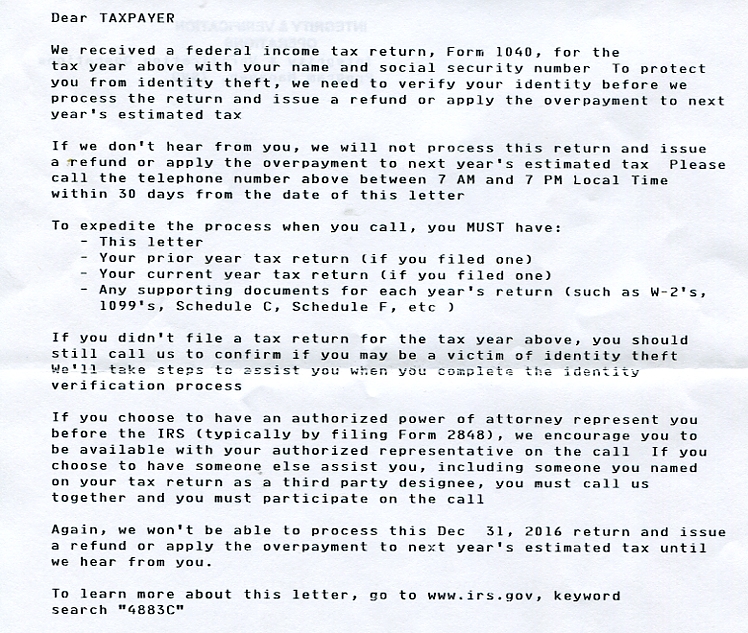

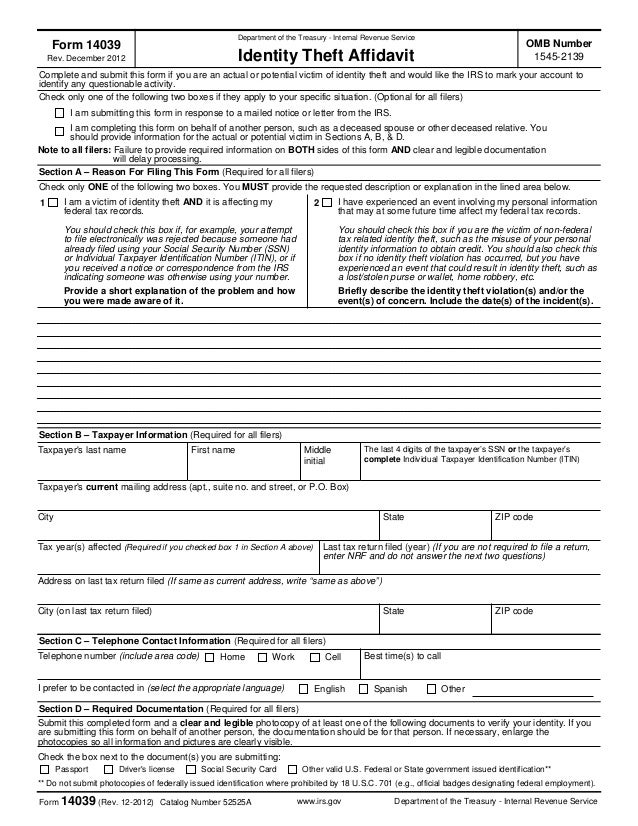

The IRS mails a Letter 5071C Letter 4883C Letter 5747C or The taxpayer tells the IRS Form 14039 A fillable Form 14039 PDF is available on IRSgov. This is a letter you should send to one of the credit bureaus if you are concerned that your credit may be threatened due to identity theft. Complete Form 14039 Identity Theft Affidavit PDF attach it to the back of your completed paper tax return and mail to the IRS location based upon the state you reside.

A notification of processing delay. Questions regarding your tax return. Continue to pay your taxes and file your tax return even if you must do so by paper.

Identity Theft Dispute Letter to a Company for an existing account. Be alert to possible tax-related identity theft if. If the IRS suspects that a tax return with your name on it is potentially the result of identity theft the agency will send you a special letter called a 5071C Letter.

Know the Signs of Identity Theft. Fax 916 843-6036 Mail. This letter is to notify you that the agency received a tax return with your name and Social Security number and.

Write down who you contacted and when. Generally most tax-related identity theft comes to light one of two ways. The IRS sends notices and letters for the following reasons.

This letter is to notify you that the agency received a tax return with your name and Social Security number and. We need more information from you before we can approve your tax refund. Call the IRS at 1-800-829-1040 and ask them about the particulars of this second filing.

You send it off to the IRS. You may not know youre a victim of identity theft until youre notified by the IRS of a possible issue with your return. Identity theft has become common enough that the IRS has a specific form to filethe IRS Identity Theft Affidavit Form 14039for notifying them that you believe you are a victim of identity theft.

The sample letter on page 20 can help. Correct your credit report. Never trust a letter just because it says IRS.

This letter is a document used by a victim of identity theft whose personal information has been used in connection with tax fraudSometimes when a persons social security number and identity has been stolen the thief is able to file a fraudulent tax filing using the victims personal information leaving the victim liable for the resulting tax bill. E-file your tax return and find that another return has already been filed using your Social Security number or The Internal Revenue Service IRS sends a 5071C letter to the address on the federal tax return indicating that tax ID theft has occurred. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for.

Wait for an acknowledgment letter from the IRS. Generally most tax-related identity theft comes to light one of two ways. If the IRS suspects that a tax return with your name on it is potentially the result of identity theft the agency will send you a special letter called a 5071C Letter.

This means that youre a victim of tax identity theft or more specifically stolen identity refund fraud. Youll receive a letter from the IRS acknowledging the IRS received your Form 14039. Complete Form INV ID1 - Identity Theft Affidavit and mail to the address on the form.

Gather the required items and complete the Request for Tax Information and Documents form FTB 4734D and send it to us. Your tax return was selected for review as a security measure to protect against tax-related identity theft. The form may be filled out online then printed and mailed or faxed.

The sample letter on page 19 can help. If you receive a notice from the IRS such as Letter 673C and you know you did not file another return you might have an Identity Theft Problem. Identity theft sample letters.

Phishing and Online Scams The IRS doesnt initiate contact with taxpayers by email text messages or social media channels to request personal or financial information. Beware of Fake IRS Letters.

Irs Audit Letter Cp05 Sample 1

Irs Letter 4883c Tax Attorney Explains Options To Respond

Irs Audit Letter 239c Sample 1

Taxpayer Guide To Identity Theft

12 Printable Identity Theft Affidavit Sample Letter Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Where S My Refund Have You Received A 5071c Letter From The Irs Saying You Need To Verify Your Identity The 5071c Letter Is The Real Deal Not A Scam It Is

Ftc Identity Theft Complaint Letter Sample Template

Https Www Irs Gov Pub Irs Utl Oc Protect Yourself From Identity Theft Final Pdf

What It Was Like To Deal With A 4883c Letter From The Irs Swistle

Https Www Prospertx Gov Wp Content Uploads Tax Id Fraud Packet Pdf

Beware Fake Irs Letters Are Making The Rounds This Summer

Irs Notice 5073c Understanding Irs Notice 5073c Potential Victim Of Identity Fraud

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

Posting Komentar untuk "How To Write A Letter To The Irs For Identity Theft"