Employee Identification Number Purpose

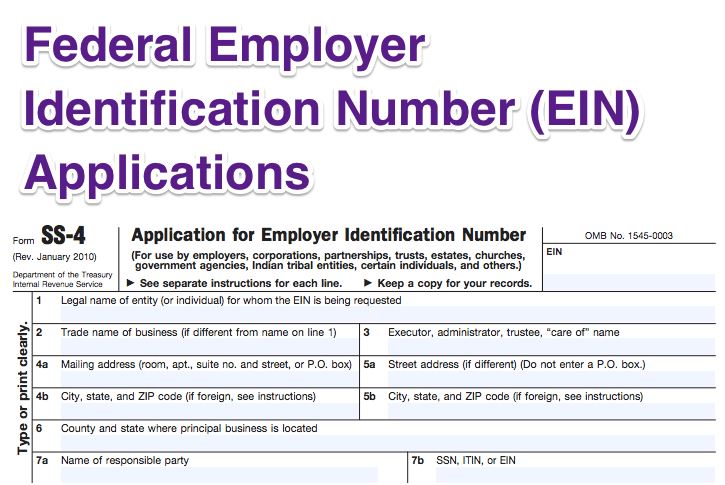

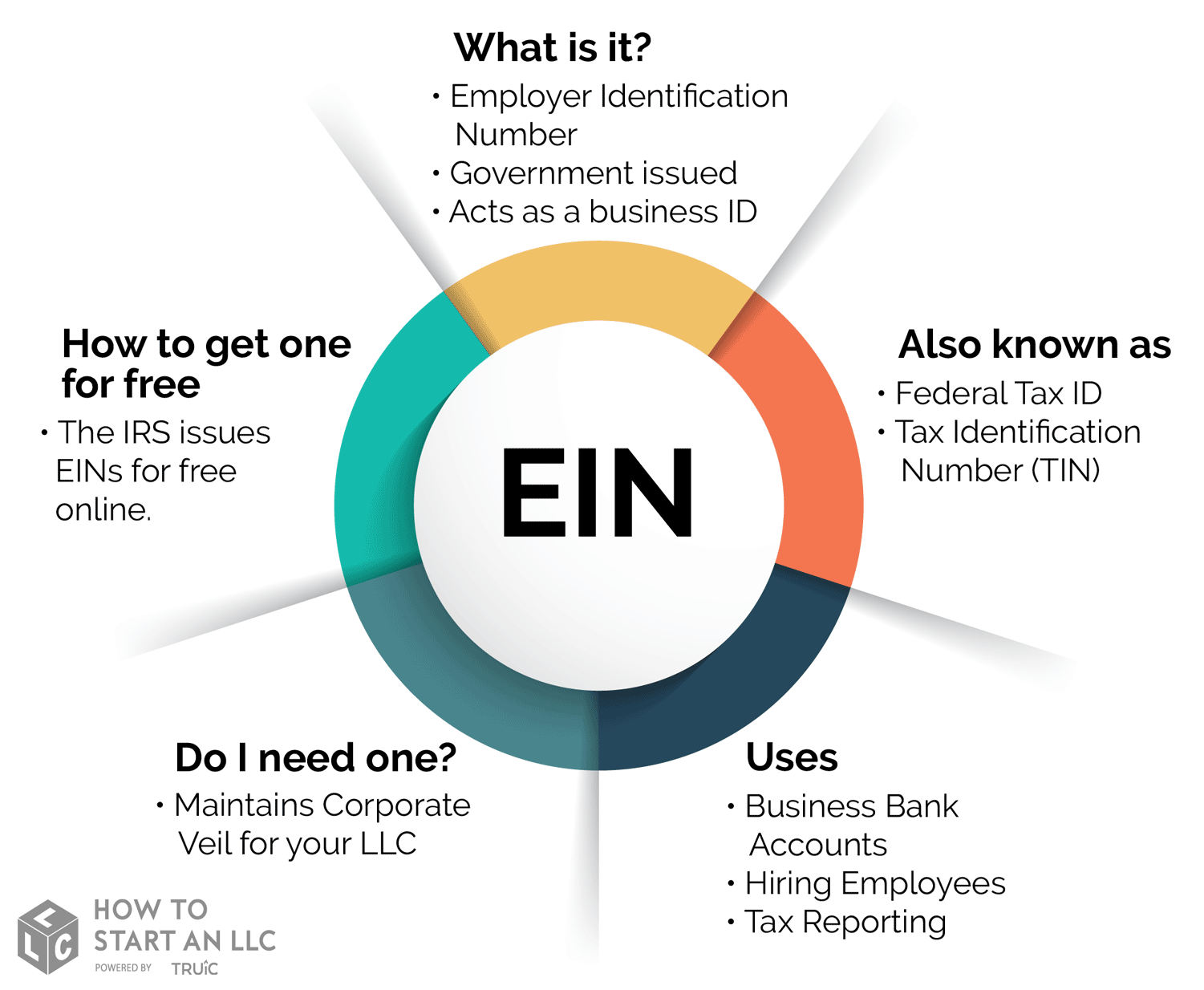

It is a unique identification number that is allotted by the IRS and helps in the easy identification of business organization for the purpose of tax filing. You may apply for an EIN in various ways and now you may apply online.

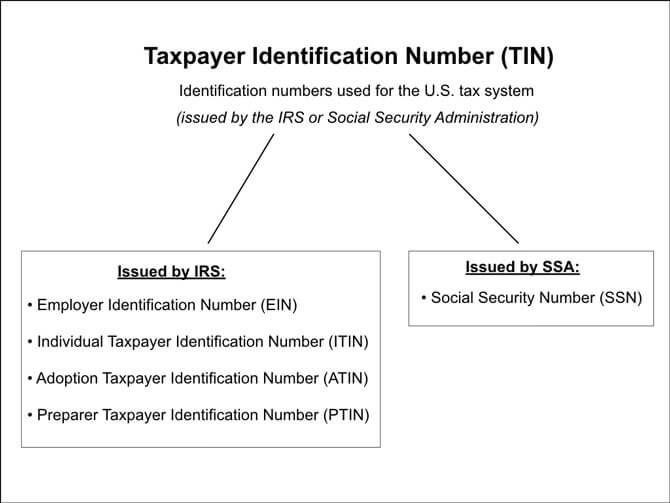

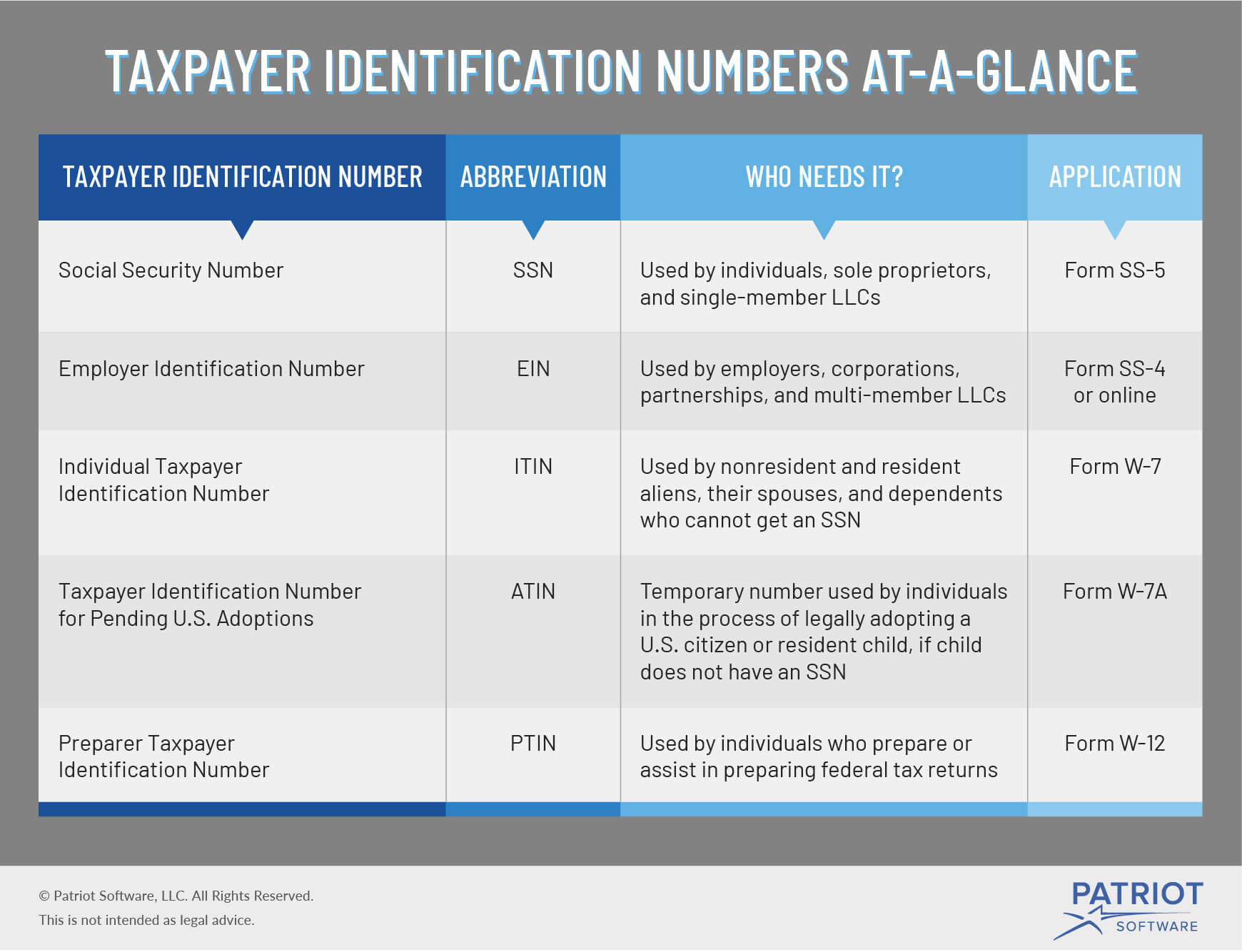

Tin Ssn Ein And Itin Taxpayer Id Numbers Llc University

Generally businesses need an EIN.

Employee identification number purpose. Employer Identification Numbers. Why psychologists should apply for one. Along with that central purpose it also serves as an identifier to entities you are engaged with.

A national identification number national identity number or national insurance number is used by the governments of many countries as a means of tracking their citizens permanent residents and temporary residents for the purposes of work taxation government benefits health care and other governmentally-related functions. An Employer ID or EIN is a federal tax identification number for businesses. An Employer Identification Number EIN also sometimes called a Federal Taxpayer Identification Number is a nine-digit number used by the Internal Revenue Service IRS to identify businesses and certain other entities.

6 In addition to being used for paying business income taxes an Employer ID is used. An employer ID number. Using your social security number for your practice could put you at risk when the federal Transparency in Coverage rule takes effect.

If youre an employee youll need to specify the EIN of the business that employs you. Employee ID numbers are useful for distributing payroll because they give bursars an easy way to distinguish between employees that requires fewer characters than writing out. Think of it as a Social Security number for your business entity.

The Data Universal Numbering System DUNS a nine-digit number issued by Dun. By banks as a requirement for opening a business bank account. The EIN number is required for many other important tasks like obtaining the necessary permits and licenses to operate the business.

Business owners use an EIN to conduct activities that would otherwise require a Social Security Number SSN. Its similar to a Social Security number but is meant for business related items only. A DUNS number helps businesses create and identify their credit reports.

Updated November 17 2020. An Employer ID Number EIN is an important tax identifier for your business. The rule seeks to make providers billing information publicly available.

This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. An Employer Identification Number EIN is a unique identification number that is assigned to a business entity so that it can easily be identified by the Internal Revenue Service IRS. More Protecting Americans From Tax Hikes PATH Act.

The Employer Identification Number is a business-oriented tax identification number that allows companies with various structures to report their taxes accurately and make payments. It works in the same way a Social Security number does for individuals and almost every business needs one. An Employer Identification Number EIN is a unique number assigned to a business for easy IRS identification for tax reporting purposes.

An Employee Identification number EIN or tax ID is essential for setting up of business organizations. An Employer Identification Number is a unique number assigned to a business for tax purposes. Most businesses need an EIN but some may not.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. Purpose of an Employer Identification Number. An EIN is a unique nine-digit number that identifies your business for tax purposes.

Your business made need an EIN for a variety of tax-related purposes and you may need a new EIN if. Although its labeled as an identifier for employers you dont have to have employees to need an EIN. An Employer Identification Number EIN is a nine-digit number issued by the IRS to keep track of a businesss tax reporting.

While there is no available directory of EINs there are several places you can find the number as either an employee or employer. The most important reason for an EIN is to identify your business for federal income tax purposes but its also used to apply for business bank accounts loans or credit cards and for state and local taxes. If youre an employer youll need to specify your businesss EIN for tax purposes.

The official term used by the IRS and other government entities is employer identification number or federal tax identification number Tax ID numbers are. Commonly known as an EIN serves as an identifier for federal tax purposes. An employee ID number is a unique string of numbers issued to each employee of a given business.

Employer Identification Numbers are issued for the purpose of tax administration and are not intended for participation in any other activities eg tax lien auction or sales lotteries etc Exempt Organization Information. One of the key responsibilities for many new businesses or businesses that are restructuring is obtaining an Employer Identification Number or EIN from the IRS.

Last Payslip And W 2 Form Tax Refund Service Estimate Tax Refund Usa Uk Ireland Picture Tax Refund Tax Income Tax

:max_bytes(150000):strip_icc()/GettyImages-172770509-b6197b1c0b664655a1c9689c22024852-bca1bcbcd0e3458f87bbe700444c5a21.jpg)

Employer Identification Number Ein Definition

Pin By Lance Burton On Unlock Payroll Template Money Template Money Worksheets

What Is An Fein Federal Ein Fein Number Guide Business Help Center

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Reference Letter For Student Unbelievable Facts Printable Job Applications

Ein Number What Is An Ein Number Truic

Employers Identification Number For Business Operations Ein Application Online Employer Identification Number Sole Proprietor Sole Proprietorship

Employment Verification Form Template Lovely 7 Employment Verification Template Employment Form Job Application Template Employment

What Is A Taxpayer Identification Number 5 Types Of Tins

How To Find Your Lost Misplaced Ein Make Your Ein Application Online Finding Yourself Confirmation Letter Online Application

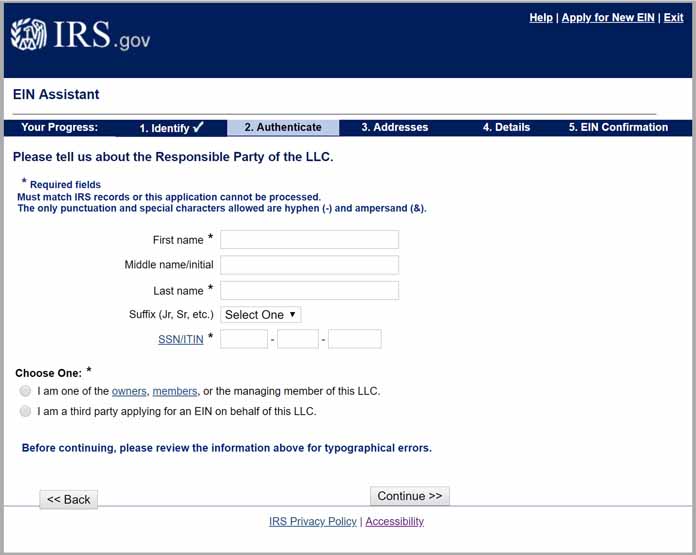

Determine Your Eligibility And Apply Online For An Employer Identification Number Ein Employer Identification Number How To Apply Employment

Ein Number What Is An Ein Number Truic

9 Common Us Tax Forms And Their Purpose Infographic Tax Forms Us Tax Income Tax Preparation

What Is The Purpose Of An Irs W 9 Form Turbotax Tax Tips Videos Independent Contractor Irs Forms Irs Taxes

Ein Number What Is An Ein Number Truic

Ein Number What Is An Ein Number Truic

Employers Identification Number For Business Operations Ein Application Online Employer Identification Number Sole Proprietor Sole Proprietorship

Electronic Irs Form W 9 2014 Irs Forms Letter Of Employment Certificate Of Participation Template

Posting Komentar untuk "Employee Identification Number Purpose"